Canzano: Shohei Ohtani and Aaron Judge may help foot bill for Portland MLB stadium

Steph Curry is paying Oregonians, why not them?

The Trail Blazers host the Denver Nuggets Friday night at Moda Center in a late-season NBA game. The visiting team flew to PDX from LAX on Thursday, slept at a swanky downtown hotel, and ate meals at local restaurants.

Also — the Nuggets’ players, coaches, and travel staff quietly paid state income taxes in Oregon.

Robert Raiola is known as the “Sports Tax Man” on social media. He lives on the East Coast, is an executive at a high-profile tax firm, and even wrote a book about clever tax strategies for athletes and entertainers.

I lean on Raiola sometimes for sports business questions. I’ve talked with Raiola several times about the beauty of a state “jock tax.” It’s designed to tax the income of visiting and home players and coaches. This happens to be at the heart of what the Portland Diamond Project wants to use to help build an MLB stadium on the South Waterfront.

The MLB to PDX entity is leaning into legislation passed in 2003 that would provide a $150 million bond. It’s only available because Oregon would theoretically tax the salaries of baseball players, coaches, and staff who work at the new stadium.

You don’t pay for it.

I don’t pay.

There are no existing tax dollars used with the “jock tax.” Schools don’t get hurt. Teachers don’t lose their jobs. No potholes are left unfilled because of it. This new tax revenue only exists because a new stadium exists. They’re not independent of each other. The athletes, executives, and coaches who work at the MLB stadium are paying an income tax. Yes, even if they’re only visiting for a single day.

That’s how it works.

Got it?

Said Raiola: “This isn’t Little League. The teams stay overnight in your state, and work in your state, so they pay taxes in your state. You can generate a ton of money, particularly if you’re talking about 81 home dates and you’re an MLB team. That could be significant money that comes in revenue.”

When Warriors guard Steph Curry plays a basketball game at Moda Center, for example, his $55.76 million salary is taxed. Oregon collects income tax from Curry based on a “duty day” formula that breaks down what his average day at work is worth. On April 15, Curry will file a bunch of 2024 state income tax returns for all the different states he played games in.

The median MLB payroll on opening day in 2003 was $55 million. In 2024, the median is expected to land around $160 million. The Mets’ payroll will be above $300 million this season. The Yankees will be north of $290 million.

The Portland Diamond Project leaders have asked state legislators to boost the $150 million bond approved in 2003. They’d like to bring it in line with the escalating MLB payrolls. They’ve asked legislators to raise the bond to $800 million.

Again, not your money.

Not my money.

No new public dollars here.

Still, this caused some predictable public outcry and the usual hysteria. One local news headline read: “Portland Diamond Project asks Legislature for $800 million.”

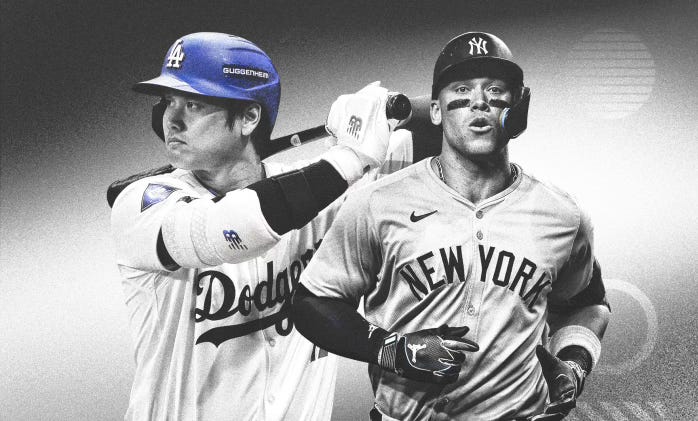

It could have read: “Shohei Ohtani and Aaron Judge may help foot bill for Portland MLB stadium.”

Who could be against that?

Nobody wants to see $800 million in public money poured into a ballpark. It feels a little excessive, except when you consider that the $800 million in tax revenue doesn’t exist without the ballpark itself. Then, it sounds like a brilliant idea.

Still, I’m bracing for the first few comments of this piece to fall in line with the comments I saw posted online after a local TV news station did a very fair and informative story about the $800 million “jock tax” ask.

One person commented: “Sounds like SCREWING the Oregon taxpayers again.”

Another wrote: “If they want MLB, they should pay for it themselves! Oh, but this Portland. We’ll get the money for a stadium from the residents for your stadium!”

So that’s where we are today, folks.

Regardless of whether the MLB to PDX effort is successful in bringing a stadium to the region, it’s worth noting that the sports franchises in the state are generating gobs of tax revenue. The visiting players don’t have a choice.

They play, so they pay.

Curry is the NBA’s highest-paid player. He files an income tax return in the state of Oregon. Oregonians should feel good about that.

“It’s not a bad move by Oregon,” Raiola said. “There’s nothing the visiting team players can do about it. The visiting team players can’t vote in Oregon. They’re not registered to drive in Oregon. They have no say at all.

“They just pay taxes.”

Ignore the nay sayers John. Excellent explanation of how taxes work! Go MLB!!

Excellent report John. Lot's of people only read headlines and fail to understand how this tax works. My nephew, who played pro football clued me in on the intricate details of how much he was taxed state by state whenever and wherever his team played. Professional (and college) sports add revenue to states if yuou consider hotels, restaurants, travel, etc. I hope this comes to fruition for Portland. The city can certainly benefit at this juncture.