Canzano: Questions and answers about Phil Knight's pursuit of the Trail Blazers

$2 billion-plus offer on the table.

If Phil Knight wants to buy the Trail Blazers, it should already be done. I wrote as much in my column when the news of Knight’s “$2 billion-plus” offer for the NBA franchise broke.

The Trail Blazers soon confirmed they received a written offer from Knight and Dodgers co-owner Alan Smolinisky. But the NBA franchise also claimed it wasn’t for sale. I don’t believe that. And you shouldn’t either.

Some questions while we wait:

Why would Phil Knight want to buy the Trail Blazers?

It’s a legacy play all the way. Knight was born in Oregon, grew up in the state and attended college in Eugene. He built an empire and made his fortune in this state. He and his wife, Penny, are prolific philanthropists and care deeply about the region. They’ve given billions to Oregon, OHSU and a line of others. They even stepped in behind the scenes years ago when Oregon State was trying to keep Notre Dame from poaching legendary baseball coach Pat Casey.

What I’m saying is — the Knights care about the region. So much so that they were willing to help a rival university retain a baseball coach because it’s what would be best for the state sports scene. I think they’re now doing the same with the region’s NBA franchise.

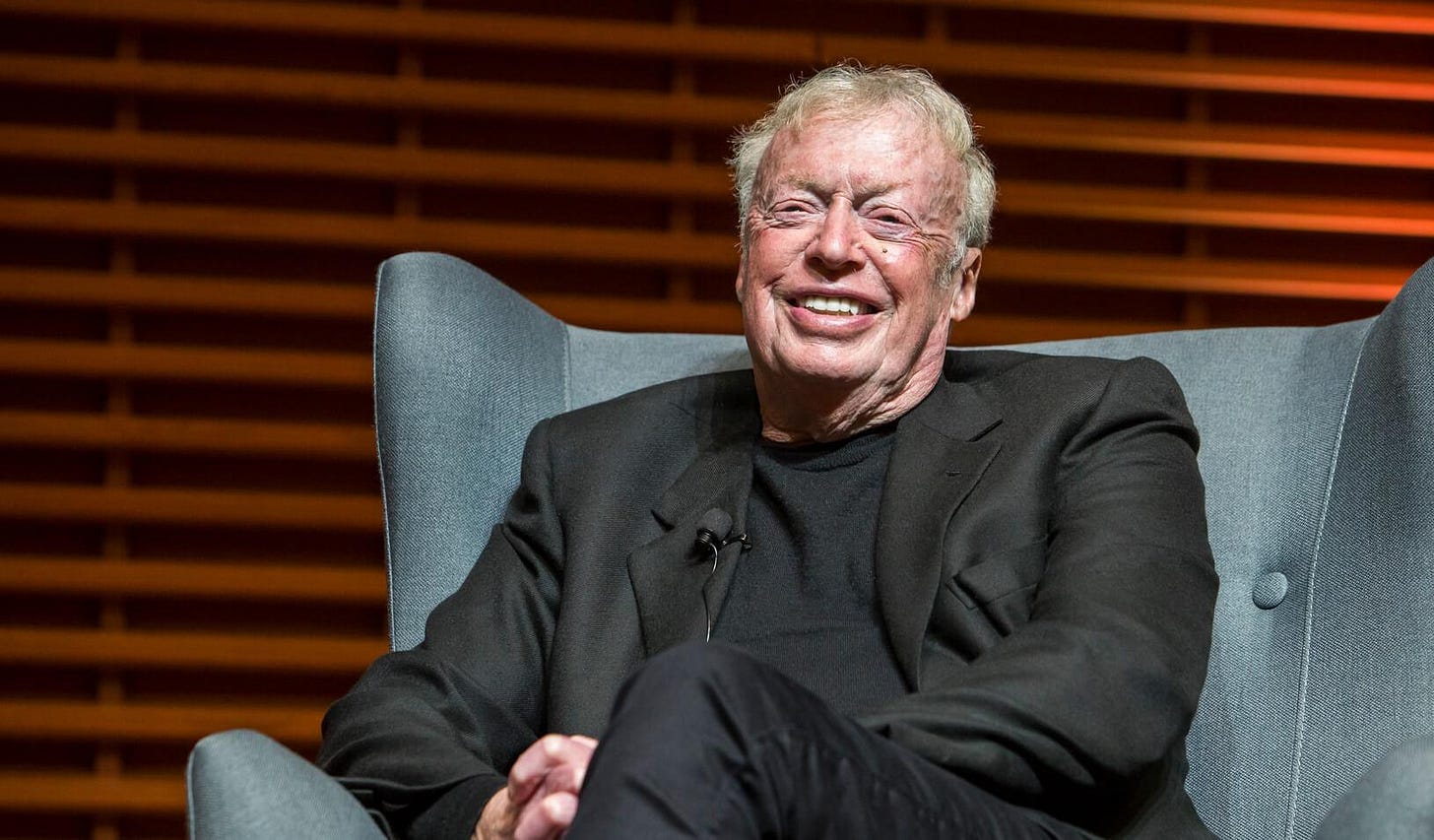

The Knights love UO, but it clearly extends beyond that. Phil Knight doesn’t need to own an NBA team. He’s 84 years old. This isn’t about making an investment in an asset, it’s about ensuring Oregon’s NBA team remains rooted in the region and doesn’t fall into the hands of an outside ownership group that might covet portability.

Why is this playing out so publicly?

Insiders tell me that if Phil Knight really wants the Trail Blazers he’s likely to get them. NBA Commissioner Adam Silver played it straight on Thursday. He confirmed that the Trail Blazers will eventually have to be sold and the Paul G. Allen Trust liquidated. This flies in the face of the Blazers’ claims that they’re not for sale.

Knight has sharp elbows in the business world. I doubt other ownership groups and billionaire investors would enjoy going head to head with him in a bidding battle for the Blazers. By going public, Knight is clearing the room some. Also, he’s put some pressure on the NBA franchise to negotiate this publicly. Also, he’s getting some good will in the region for stepping up.

The Blazers were busy preparing the franchise for auction. They planned to use Allen & Co., which is currently handling the sale of the NFL’s Denver Broncos. I’m not sure that plan works as well with Knight publicly bidding. His offer is north of $2 billion. The Blazers, I’m told, targeted $3 billion as their sales price. That would likely have to include the real estate the franchise owns around the Moda Center, the arena itself and the practice facility.

Why now?

The Paul G. Allen Trust held real estate, boats, automobiles, a submarine, the NFL’s Seahawks and NBA’s Trail Blazers, among other assets.

Last November, the trust sold off “Octopus” for $266 million. It was the 414-foot super yacht that Allen owned. It included a movie theater, a pool, a helicopter, a submarine, a glass-bottomed underwater observation lounge, a freshwater pool, a library and a pizza oven.

In January, the trust then sold a 120-acre estate Allen owned in Southern California. The actress Greta Garbo long ago nicknamed it “Enchanted Hill.” Allen bought it in 1997 for $20 million. The trust sold the property for $65 million.

There is no wiggle room with the trust. Everything in it must eventually be liquidated and the funds are supposed to be earmarked for philanthropy and Paul Allen’s passion projects. It’s just a matter of timing for all the assets. When I saw the yacht and real estate sold off first, I wasn’t surprised. Those are simpler transactions, but we’re creeping toward a moment of truth for the Trail Blazers.

The NBA’s domestic television rights are wrapped up in this, too. Each franchise currently receives about $80 million annually from the league’s current TV deal with ESPN and Turner Sports. The league expects to see a massive increase ($275 million to $300 million per team) when the contract is re-upped beginning in 2025.

There was some speculation on Thursday that the Blazers might desire to slow play the sale so it can benefit from the TV-deal windfall. Could be, but I think that number is already baked in to the $3 billion target price.

I joined the Dan Patrick Show on Friday morning to talk about it:

Should Phil Knight’s age be a concern?

He’s 84. It’s possible the Trail Blazers could eventually end up in one of his well-documented trusts. But I thought the addition of Dodgers’ co-owner Alan Smolinisky was interesting. Knight doesn’t need Smolinsky’s money to afford the franchise. But it offers a viable contingency plan.

Smolinsky is 42 and his background is in commercial real estate. As I learned more about him I thought about the untapped potential of the Rose Quarter. The area around Moda Center and Memorial Coliseum could be developed in a way that makes buying the team for $2 billion or even $3 billion look like a steal decades from now.

The Knights have two living children, Travis and Christina. Matthew passed away in an accident in 2004. I’m not as concerned about what happens to the Trail Blazers years from now as I am about what is going to happen in the next six months.

Does Knight’s Nike connection present a conflict?

The easy answer — not really. The NBA owners care about revenue, growth and the valuations of their franchises. Including Phil Knight among the NBA’s Board of Governor’s adds value to the room.

Knight founded the sneaker company but he’s no longer involved in day-to-day operations at Nike. The league has worked around potential conflicts before (See: Michael Jordan) in order to add a high-value owner to the mix. I asked one league executive about this and he said, “If Phil is serious, it’s his team to lose.”

What happens now?

There’s some public negotiating going on right now between Knight’s group and the Trail Blazers braintrust. Part of NBA Commissioner Adam Silver’s job is to make his rich owners even wealthier. The valuations of the teams are tied to that. The other owners would all love to see the Portland team sell well above the Forbes valuation of $2.05 billion.

The Blazers will likely soon leak (if they haven’t already) that they’ve received multiple offers for the franchise. They won’t want Knight and Smolinsky to believe they’re bidding without competition. This is a negotiation. I’m told by league executives that if all things are equal — meaning, the money in the offers — Silver would nudge the Blazers toward a deal with Knight. He’s the right owner and the NBA would be better off with Mr. Swoosh in the room.

However, if there’s a bid that comes in well above what Knight is offering, Silver might not be able to do that. I think it helps explain why Knight went so publicly and so strong with his written offer. He wanted the world to know he’s serious about owning the Trail Blazers.

Thank you for reading. I appreciate all who have supported, subscribed and shared my new independent endeavor with friends and family in recent months. If you haven’t already — please consider subscribing.

Phil's living son is Travis! Matthew died in a scuba diving accident years ago... Hence Matt Court!

Thanks for the insightful coverage of Uncle Phil’s bid.

This is late but your response to the horrific murders in Texas struck a strong chord here. We are with you. Sign that petition!